If you are an entrepreneur, you need to issue Form W-2 and Form 1099 to your organization’s employees every year.

But are you aware of these two forms?

You can invite potential fines for yourself if you provide an incorrect form to your company’s employees. To avoid facing such issues, it is imperative to know the difference between Form 1099 and W-2 and how these are related to payroll.

What Is Form 1099?

There are several types of Form 1099, but all of them cater to the same purpose – taxpayers use them to provide information to the IRS (Internal Revenue System). This information is about the various kinds of income that individuals receive apart from the regular salary throughout a year.

To avoid an audit, taxpayers must report every outside income to the Internal Revenue System. This income can include investment dividends, freelance work compensation, or bank interest. Issuers of Form 1099 should send one copy to the taxpayer or recipient of the payments and another one to the IRS. Some issuers send their forms electronically, while some do it via mail.

Two common 1099 forms are 1099-MISC and 1099-NEC. Freelancers or independent contractors receive these forms to report the paid wages without taxes withheld to the IRS.

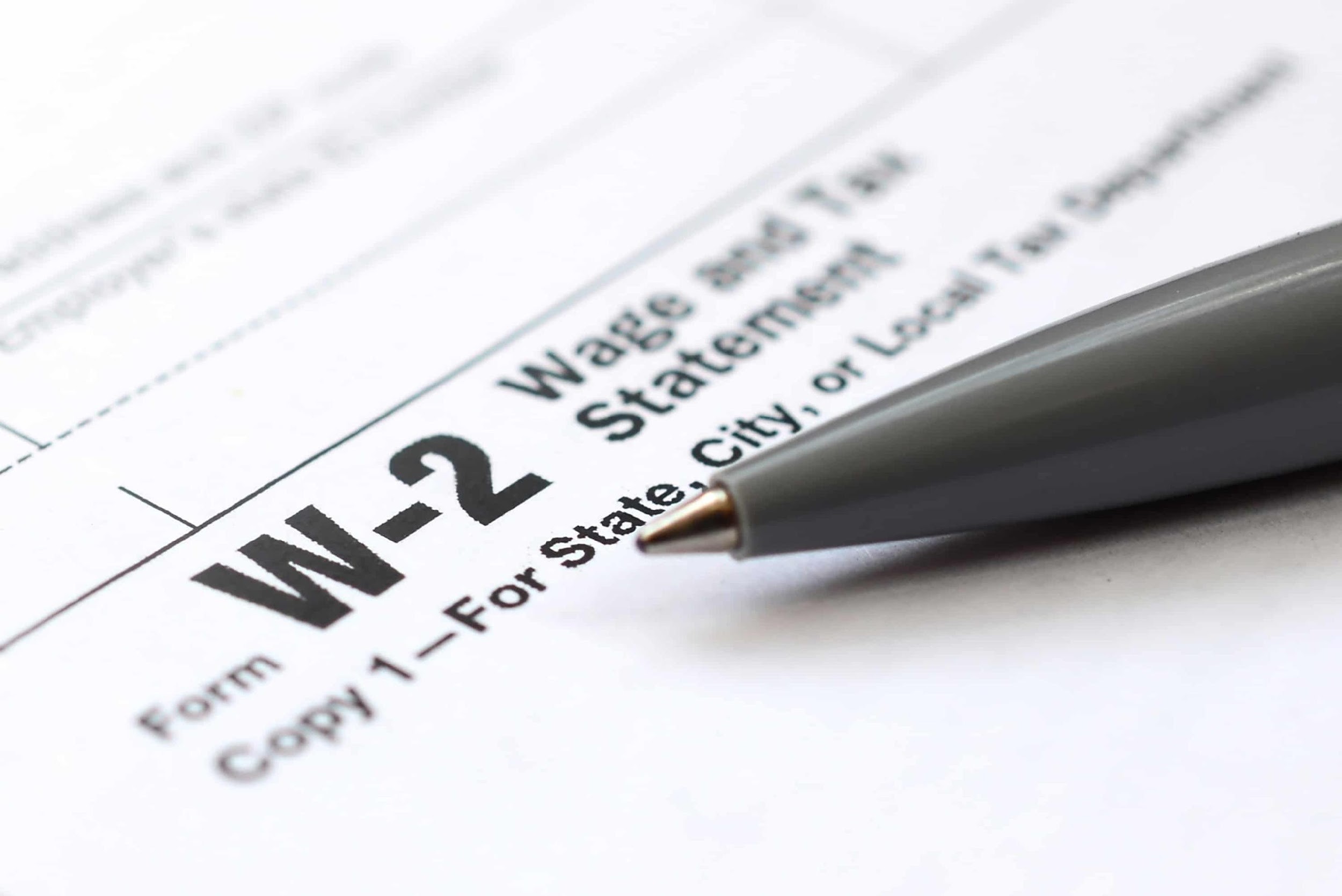

What Is Form W-2?

Also known as the Wage and Tax Statement, Form W-2 is a document that an employer needs to send to all employees and the IRS (Internal Revenue Service). Form W-2 reports the tax amount withheld from the paycheck and annual wages of the employees.

Employers should also use Form W-2 to report FICA (Federal Insurance Contributions Act) taxes for their employees throughout a year.

Form W-2 covers the following information for a tax year:

- State Income: Amount that was withheld for state income taxes (if any)

- Taxable Income: An employee’s income and the portion of that income that was withheld for federal taxes

- Social Security and Medicare Income: Amount withheld for FICA taxes

Some more essential facts to keep in mind regarding Form W-2 include:

- Earnings cover non-cash payments of $600 or more for a year

- Form 1099 determines whether an individual makes a payment or gets a refund during tax season.

- Employers should offer the employees copies of their W-2 forms by the end of January every year.

How Are Form 1099 and Form W-2 related to payroll?

A Form W-2 contains all information starting from the year’s first pay-check to the final processed payroll. Employees who receive this form receive an overview of all taxes withheld, deductions made for health insurance or retirement contributions for a calendar year and earned wages.

Typically, employers start to verify employee details in October and November to prepare for year-end processing and Form W-2 distribution to employees. The kind of information that must be verified include the following:

- Employee addresses

- Employee names

- Social security numbers

After verifying or correcting this information, employers prepare to generate Form W-2 for its distribution in January. If employers use a provider that provides payroll tax compliance services, then this procedure can be as simple as making Form W-2 available to employees in an online portal for easy access.

A key difference exists between a Form W-2 and a Form 1099. The former is issued to an employee to report their payroll taxes and income withholding. And, the latter is given to an independent contractor to report income to the IRS.

Besides these forms, if you seek a reliable payroll service provider, you can get in touch with us. For reference, you can go through our blogs to learn more about our customized payroll services.

Reference Links:

https://www.investopedia.com/terms/w/w2form.asp

https://www.stoketalent.com/blog/difference-between-w2-and-1099/

https://www.investopedia.com/articles/personal-finance/082514/purpose-1099-forms.asp

https://apspayroll.com/blog/difference-form-w-2-and-form-1099-misc/

https://www.irs.gov/government-entities/form-w-2-and-form-1099-misc-filed-for-the-same-year

Contact Us

Find out if a PEO is the right solution for your business.

Fill out the form below and we will contact you to schedule a chat.